Three Travel Advisors Have Very Different Experience with PPP and SBA Loans

by Daniel McCarthy

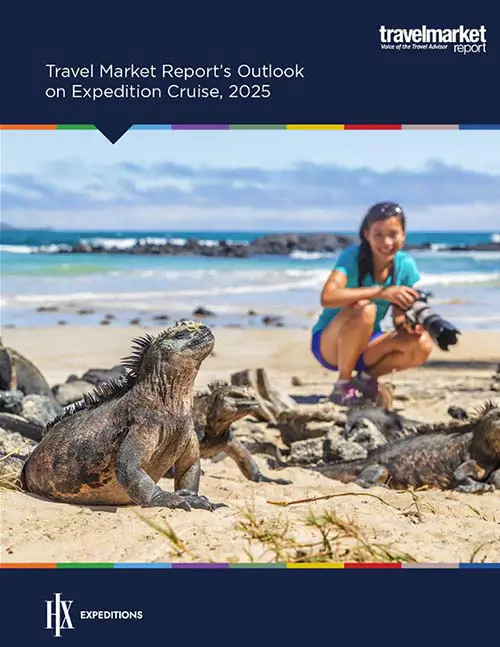

The PPP loan and SBA loans, despite their shortcomings, helped save some travel agencies. Photo: Shutterstock.com

The CARES Act’s PPP and SBA loans were supposed to be a lifeline for advisors as travel came to a screeching halt last month because of the impact of COVID-19, the result of an unprecedented campaign by ASTA to help save the travel industry and travel trade in light of one of the biggest crises the industry has ever faced.

With a heavy reduction in income, advisors needed a way to pay employees, to pay rent if they owned a storefront, and to stay in business in preparation for the industry’s recovery. The industry needed advisors and the PPP and SBA loan programs, along with some other government programs including an extension to unemployment benefits, would keep advisors afloat while they waited for the lights to come back on.

The program, for some advisors, has done just that, but for others—it hasn’t functioned as smoothly as they had hoped. Here is what travel advisors speaking to Travel Market Report last week had to say about their experiences with the programs:

‘Helped preserved my business’ but was vague on details

One Wisconsin-based agency owner told TMR that in late March, she applied for the Economic Injury Disaster Loan (EIDL) program through the SBA. The online form, she said, was under 10 questions and didn’t take long to complete. At the end, after the SBA asked for her bank account information, she received a confirmation number and that was it.

It wasn’t until about three weeks later that she heard back from the SBA, which told her that “due to unprecedented need, they were delayed and were reviewing my application.”

In the meantime she also applied for the PPP using a small community bank where she did not currently have a line of credit but had banked with for about seven years. Her bank’s PPP portal opened on April 3 at 9 pm and her application was submitted an hour later. After applying and talking to a banker at the bank, she didn’t hear back for ten days when she was finally told her loan was approved.

“I did a docu-sign the following day and my loan was funded about a day later. The loan paperwork was incredibly vague, and the bank did not have many clarifications about it,” she told TMR.

“The loan paperwork did not list what the payment would be should it not be forgiven, and it did not list the total interest. It was the third largest loan I have signed for in my life but had the least amount of information.”

She spent the next few days doing whatever she could to gain clarity on the loan, but still hasn’t gotten much else. After that, she discovered that she had received the full EIDL in her company bank account, another big loan made with “no documentation, no email, and no snail mail information on the money.”

Despite the vagueness, she said she is “so thankful for the loan and the grant.”

“I had to reduce my team’s hours and would need to have looked at a 75% layoff without the loans. I now have 60 days of funds to pay my team at their full salary as well as rent and utilities and to help preserve our capital.”

Some frustration

One North Carolina-based travel agency owner told TMR that she missed the first round of applications for the loans “because it closed before I even had time to figure it all out. I was busy rebooking cancelled trips and didn’t have enough time to investigate it properly.”

At the time the programs opened up, she couldn’t get a hold of her local bank, which made her shy about applying for the loan before knowing all the details, and “then suddenly it was out of money so it didn’t matter.”

When the second round of applications opened up, she again contacted her bank but was told applications were again closed. After pushing back a bit “miraculously I got a phone call that they were accepting applications at my bank.”

“It took a few hours but I completed the form and sent it in. The bank officer I worked with sent it back a few times for minor corrections” including some missed signatures or some mistakes filling in the forms, but she was able to complete it by the end of the day of April 23.

As of the end of the day on April 28, she hadn’t heard anything back from her bank about the progress of her application or the loan status.

No such thing as a free lunch

One Minnesota-based travel agency owner said that the PPP loan she got allowed her to remain at full-staff (though she and her 18 employees are all remote at this point).

Again, when the initial CARES Act was passed, her and her team were “very busy trying to work with customers and vendors” but after that slowed down, they were able to assess the PPP program and apply, and have been granted, a loan.

Part of the program was predicting 2020 losses, which she said had been difficult. Ultimately, she was happy that she was able to keep her staff employed, though she warned that there are strings attached with the PPP that advisors need to be aware of.

“The PPP is a great inducement of cash at a very low cost. If we get some forgiven, which we aren’t banking on, we will be happy. We need to cut some fat, get lean, and use our muscle, but not get too skinny as this could result in not having a business!” she said.

“Our agents and their clients are our future. The advisors and the relationships they have with their customers is our future. To cut our advisors would be cutting future business.

“We are happy to have this to assist with cash flow to make it through these times, but there is no such thing as a free lunch,” she added.