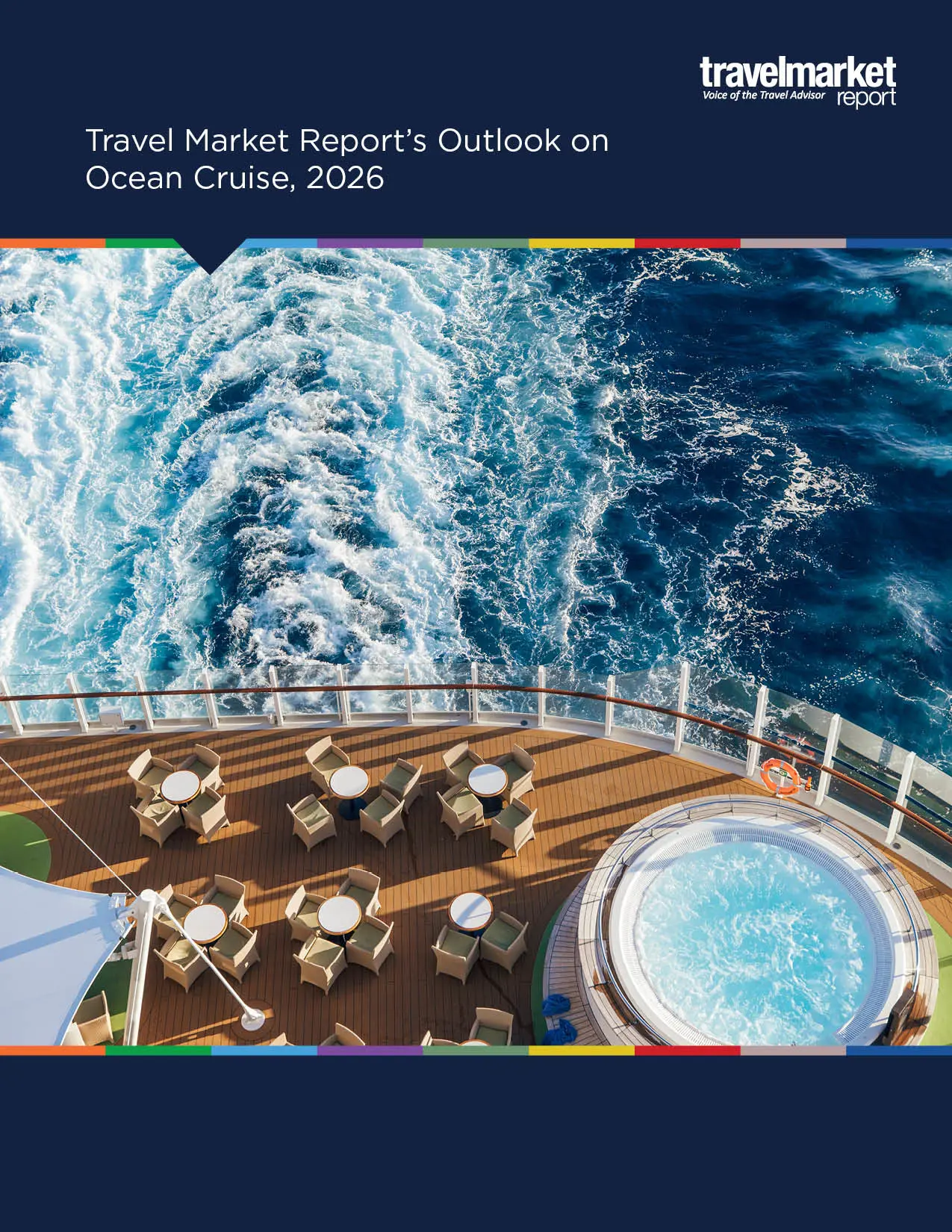

Money Major Factor for New-to-Cruise Clients

by Dori Saltzman

Photo: Dori Saltzman

Cruise lines are seeing an increasing number of new-to-cruise guests coming onboard and giving the vacation option a chance. In a new study, three travel brands (CLIA, MMGY Global, and Travel Zoo) joined forces to find out why. Among the findings of “From Shore to Ship: Attracting the Next Wave of Cruisers,” researchers found that the perceived value for money of cruising has improved but that promotions and discounts are still highly influential.

Here are some of the highlights from the study.

Money still a top factor

Money continues to be a primary influencer for potential cruisers. Forty-one percent of U.S. respondents listed “personal financial impediments” as a major barrier when considering a cruise, showing that many potential cruisers still see cruising as too expensive. Thirty-seven person also said they were discouraged from booking a cruise in the past due to the additional costs of excursions.

Yet the value for money of cruising is improving. When asked about the perceived value for money of cruising, only 36% cited a low perception of the value of cruising as a current concern. Yet 60% of respondents said this perception has been a reason for not booking a cruise in the past.

Nevertheless, potential cruisers continue to be swayed by anything that increases their spending power. When asked what would make cruises more appealing, 52% of respondents said promotions and discounts, while 35% said the availability of comprehensive all-inclusive packages and options.

Other top answers included information on health and safety standards (39%), extended time in port to explore destinations (37%), and a variety of destination offerings (36%).

New-to-cruise stay closer to home

Interestingly, the research found that destinations within close proximity to the U.S. are the most appealing to potential new-to-cruise Americans, with the Caribbean/Bermuda region the most popular at 63%. Hawaii and the Mediterranean follow at 48% and 40% respectively. Other destinations that registered high interest were Alaska (39%), Northern Europe (26%), and Mexico/Pacific Coast (26%).

Friends and family top info sources

Friends and family are overwhelmingly the most influential information sources for potential cruisers, with 58% of respondents saying they turn to friends and family when researching travel options. Other influential sources include destination websites (34%), travel review websites (29%), and online travel agencies (29%).

Lack of understanding regarding sustainability

According to the study the majority of prospective cruisers said they are willing to pay more for travel services that demonstrate environmental responsibility. But most don’t know anything about what the cruise industry is doing. For instance, slightly more than 60% of those identified as potential cruisers said they have a familiarity with responsible travel. But less than 30% of this same segment said they are somewhat familiar with cruise sustainability practices.